A routing number is a crucial component of financial transactions ensuring that funds are processed accurately and securely. Found on every check it helps identify the bank where an account is held. But how do you find it? Let’s break it down.

Where to Find the Routing Number on a Check

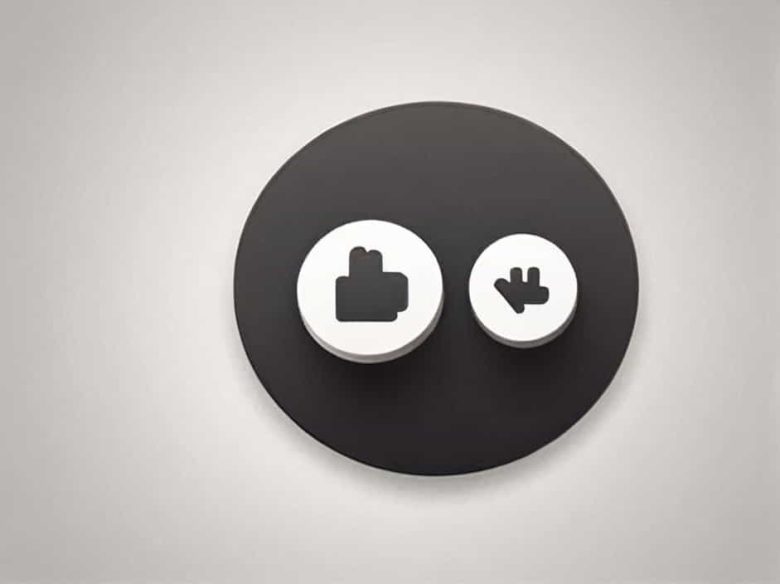

If you look at the bottom of a check you’ll notice three sets of numbers. These represent different financial details:

- Routing Number – The first set of nine digits on the far left.

- Account Number – The second set of numbers in the middle.

- Check Number – The last set on the right which corresponds to the specific check.

Since routing numbers are standardized across U.S. banks you can always find them in this position on any check.

What is a Routing Number?

A routing number consists of nine digits and serves as an identifier for financial institutions. These numbers are assigned by the American Bankers Association (ABA) to ensure smooth processing of transactions like direct deposits electronic transfers and check payments.

The Structure of a Routing Number

Each routing number is structured as follows:

- First digit: Represents the geographic region of the bank.

- Second to fourth digits: Identify the specific financial institution.

- Fifth to eighth digits: Sometimes indicate the bank branch.

- Ninth digit: A checksum digit used to verify the validity of the number.

This system ensures that payments are sent to the correct institution without errors.

Why Are Routing Numbers Important?

Routing numbers play a critical role in financial transactions including:

- Direct deposits (e.g. salary payments)

- Electronic fund transfers (EFT)

- Wire transfers (domestic and international)

- Bill payments and online banking transactions

- Check processing

Each bank has a unique routing number and some larger banks may have multiple routing numbers depending on location or transaction type.

Different Types of Routing Numbers

Not all routing numbers serve the same purpose. Banks use different routing numbers for various transactions:

- ABA Routing Number – Used for checks and traditional banking operations.

- ACH Routing Number – Used for electronic transactions like direct deposits and bill payments.

- Wire Transfer Routing Number – Sometimes differs from the ABA routing number and is required for sending money through wire transfers.

It’s essential to verify the correct routing number with your bank before making a transaction especially for wire transfers.

How to Find a Routing Number Without a Check

If you don’t have a check on hand there are several ways to locate your routing number:

- Bank’s Website – Most banks list routing numbers on their official site.

- Mobile Banking Apps – Your account details often include your routing number.

- Bank Statements – Monthly statements may include this information.

- Online Directories – Some websites provide lists of routing numbers for major banks.

- Customer Service – You can always call your bank to confirm the correct routing number.

Common Misconceptions About Routing Numbers

1. Does Every Bank Have the Same Routing Number?

No. While small banks may have one routing number large banks can have multiple numbers depending on the state or type of transaction.

2. Is the Routing Number the Same as an Account Number?

No. The routing number identifies the bank while the account number is unique to your personal account.

3. Can I Use Any Routing Number for Transfers?

No. Always use the correct routing number for the type of transaction (ACH wire transfer or check processing) to avoid delays or errors.

Final Thoughts

Routing numbers are a fundamental part of banking ensuring that transactions are processed correctly and securely. Whether you’re setting up direct deposits making an online payment or writing a check knowing where to find and how to use your routing number is essential for seamless banking operations.

By understanding routing numbers you can avoid payment errors and ensure your transactions go through smoothly. Always verify the correct routing number with your bank before making a significant financial transfer.